Sep ira contribution calculator

Sep 7 2022 0441pm EDT. Since you are not self-employed you do not need to be using TurboTax Self Employed.

Free Simple Ira Calculator Contribution Limits

Ditto for catch-up contributions.

. Roth IRA calculator. SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing. An employer may establish a SEP IRA for an employee who is entitled to a contribution under the SEP plan even if the employee is unable or unwilling to establish a SEP IRA per IRS rulesSee 5305-SEP.

Its a common problem but can be remedied. 6000 or 7000 if you are over 50 years old. Consider a SIMPLE IRA if your small business has steady income and your employees want to make contributions to a retirement plan.

Save on taxes and build for a bigger retirment. You can decide what amount to contribute each year from 0 to the maximum SEP-IRA contribution 25 of compensation 20 if youre self-employed 4 or 58000 for tax year 2021 or 61000 for tax year 2022 whichever is less. The contribution to your SEP IRA must be made by the S corp and is deductible on the S corps tax return not your individual tax return.

Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. See Traditional IRA contribution limits for tax years 2018 and 2019. Internal Revenue Code Sections 402h and 415 limit the amount of contributions made to an employees SEP-IRA to the lesser of dollar limitation for the year 61000 for 2022 58000 for 2021.

Estimate Your Taxes. Contribution Limits for IRAs. Each option has distinct features and amounts that can be contributed to the plan each year.

Compare the features of these retirement plans and determine whether your situation is better suited for a SEP IRA or Individual 401k. Other limitations may. Contribution limits for 2021.

If you have another job ie a day job your maximum employee contribution is reduced by any contributions you made as an employee to another 401k or 403b. Yale Her work has been published in Forbes Money Magazine Bankrate The Motley Fool The Balance Money Under 30. They also come with smaller contribution limits than 401ks and SEP IRAs.

SEP IRA A SEP IRA Simplified Employee Pension is a retirement account for small business owners or self-employed people. All contributions made to a SEP are employer contributions. A flexible and easy to manage retirement plan Open a SEP IRA A Simplified Employee Pension SEP IRA is a retirement plan that allows for higher tax-deductible contributions tax-deferred growth hassle-free account maintenance and a flexible contribution schedule making it a good choice for small business owners and self-employed.

The amount of contribution for himself to the plan. SEP IRA Personal Defined Benefit Plan Overview FAQs SIMPLE IRA. Also loans are permitted with an Individual 401k.

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Contact your IRA administrator about the excess contribution and withdraw it plus any earnings to avoid a 6 tax penalty. 56000 for 2019 and 55000 for 2018 or 25 of the employees compensation.

The 2022 contribution limit for both traditional and Roth IRAs is 6000. Simply enter your name age and income and click Calculate The result will be a comparison showing the annual retirement contribution that would be permitted based on your income in a SEP IRA Individual 401k Defined Benefit Plan or. The employer contribution is limited to half of the difference between your net earnings from self-employment and the employee contribution.

Features and benefits of a SEP IRA. Partial deductibility is available for MAGI up to 125000 joint and 76000 single. An Individual 401k may allow a greater contribution than a SEP IRA due to the way the contribution is calculated.

Your 2022 Roth IRA contribution limit is either 6000 if you are under 50 or 7000 if you are 50 or older. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA based on your income and age. Whichever is lower of 56000 or 25 of compensation per employee.

A SEP IRA a SIMPLE IRA or a Profit Sharing plan. Use the Solo 401k Contribution Comparison to estimate. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator.

The maximum your S corp can contribute to your SEP IRA is 25 of your W-2 compensation. Americans who are 50 or older can contribute an additional 1000 in catch-up contributionsThe IRS stipulates this so those nearing retirement can set aside a bit more. Find out how much of your IRA contribution may be tax-deductible.

Contributions limits vary per filer. That could be an important advantage over a SEP IRA where your entire contribution is limited to 25 percent of. To determine the amount of his plan contribution Joe must use the reduced plan contribution rate considering the plan contribution rate of 10 of 90909 from the rate table in Pub.

The maximum SEP IRA contribution is the lesser of 25 of adjusted net earnings or 58000 for 2021 61000 for 2022. A SIMPLE IRA is a retirement plan for small businesses that offers your employees a salary-deferral contribution feature along with a matching employer contribution. Contribution limits for 2021.

For a Traditional IRA for 2021 full deductibility of a contribution is available to active participants whose 2021 Modified Adjusted Gross Income MAGI is 105000 or less joint and 66000 or less single. TurboTax Premier is sufficient. Find out how much you can contribute to your Solo 401k with our free contribution calculator.

Alternatively Joe can compute his reduced plan contribution rate by. Traditional IRA calculator.

Solo 401k Contribution Calculator Solo 401k

Freelance Target Income Calculator Calculate Your Ideal Income

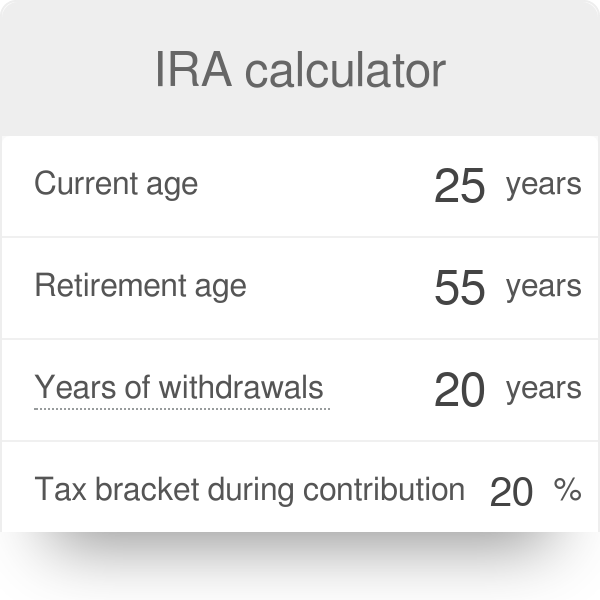

Ira Calculator

What Do I Need To Do To Calculate And Correct An Excess Ira Contribution Legacy Design Strategies An Estate And Business Planning Law Firm

Sep Ira Calculator Sepira Com

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Ira Retirement Calculator Forbes Advisor

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Compound Interest Calculator Roth Ira Sale 57 Off Www Ingeniovirtual Com

Sep Ira Contribution Calculator For Self Employed Persons

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Sep Ira Calculator Ruby Money

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Sep Ira Plan Br Maximum Contribution Calculator

Ira Calculator See What You Ll Have Saved Dqydj